Battlefield metaphors are often over-used when commentating on business affairs. But to describe the global iron ore industry over the past three years as a ‘war’ is to exaggerate only a little.

The ‘big three’ – BHP Billiton, Rio Tinto and Vale – have deliberately ramped-up production over this period, even as global prices have fallen, in an attempt to drive small operators out of the industry. Although it is high-cost Chinese miners who are the primary target, the emerging African iron ore producers – Guinea, Sierra Leone, Cameroon and the Republic of Congo – could be casualties too.

In this ‘war’ there is only one trophy to excite passions: the Chinese market. The country buys about two-thirds of the rest of the world’s iron ore exports and, in addition, produces almost the same volume domestically.

China’s surging manufacturing economy, with its annual GDP growth figures in excess of 10% from 2003 to 2007, drove a massive expansion in demand for iron ore, the prime ingredient for steel production. Its imports tripled after the millennium.

These were happy days for established iron-ore mining companies, with the price of the commodity rising from US$30 per ton in 2003 to a peak of US$190 per ton in February 2011. During this time, it seemed that every man and his dog were searching for unmined deposits and floating an iron ore mining firm.

It was during this period that West and Central African deposits of the metal came into focus. Iron is the fourth most common element in the Earth’s crust. However, it only occurs in sufficient purity and volume in certain isolated locations. The most viable ore bodies are more than 60% pure, which means it can be fed directly into a blast furnace without intermediate processing.

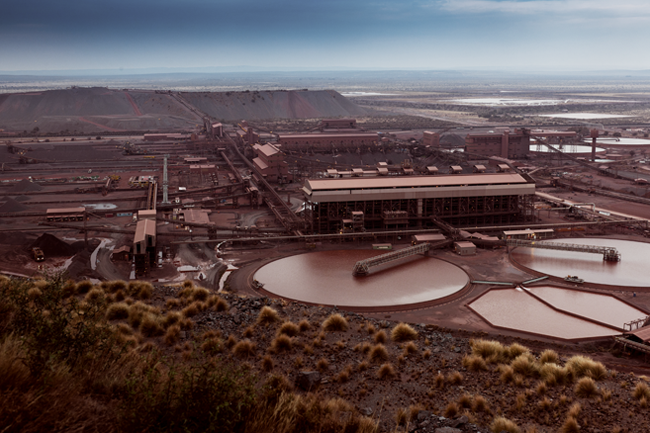

The richest iron ore mining regions in the world are Pilbara in Western Australia, which produced 280.6 million tons of iron ore in 2014 and Brazil (320 million tons) – home to some of the largest mines, including Carajás. By comparison, South Africa produces less than 70 million tons.

The third potentially rich zone is West Africa’s Republic of Guinea (sometimes called Guinea-Conakry to distinguish it from Guinea Bissau and Equatorial Guinea). Indeed, the reserves are so massive the country has been referred to as ‘the new Pilbara’.

It has been known for many years that vast iron ore deposits exist at Mount Nimba, an ecologically sensitive area in the south-east of Guinea. In 1998, an even richer deposit, estimated at 2.2 billion tons, was discovered at Simandou, in the same region.

This seems to have been a lifeline for Guinea, one of the world’s poorest states. However, even before the Simandou discovery, the country was a classic case study in the so-called ‘resource curse’, whereby a corrupt governing class reaps the rewards of mineral wealth while the rest of the country is mired in conflict and poverty. Guinea also possesses one-third of the planet’s known bauxite (the core constituent of aluminium) and has substantial diamond and gold deposits too.

However, the development of its iron ore has been steeped in controversy. In 2008, when Guinea’s then dictator Lansana Conté was on his death bed, he signed an executive order – allegedly at the behest of his wife – transferring ownership of the northern half of Simandou from global giant Rio Tinto to a company called BSG Resources.

The latter was controlled by a family trust linked to Israeli businessman Beny Steinmetz. However, he promptly sold his rights to Rio Tinto’s great rival, Brazilian company Vale, making US$2.5 billion in the process. The legal wrangling has been almost continuous ever since.

Vale stopped payments to Steinmetz after the first half-a-billion dollars. Alpha Condé’s newly elected government withdrew the rights in April last year and has since put them up for auction again. Vale, Rio Tinto and BSG Resources have all turned to the international courts in a frenzy of mutual litigation.

Of the contenders, Rio Tinto appears the most determined. The firm still retained half of Simandou, paying US$700 million in 2011 to secure its asset. But observers comment that production is at least five years away and with the global market in its present state, Guinea may have missed its moment. Rio Tinto may well prefer to sit on the asset or, more likely, go slow on development, doing just enough to keep its rivals out.

The big problem producers face is that iron- ore mining involves massive infrastructure. Excavating the metal requires little more than large machines digging a big hole in the ground but getting the mined ore to market is the really big challenge. Simandou and Mount Nimba are several hundred kilometres from the sea. Hence, new rail and port facilities are a necessary part of developing the asset.

It was recently announced that Rio Tinto has plans to spend some US$20 billion on building a 650 km railway and a deepwater port. However, these projects are never simple.

The financing alone will undoubtedly involve a company contribution, the World Bank, private-sector finance and funding from the government. Who pays for what and the conditions of risk under which they do so is a delicate matter that will likely take years to arrange.

However, at least Guinea has in Rio Tinto a big player on its side. The African countries that went with small ambitious-development companies show what the worst of the downside could have been.

London-based African Minerals is the firm driving iron ore mining in Sierra Leone – in March this year, it went into receivership in the UK. Mining operations were suspended in late 2014. It had invested US$2 billion in developing the massive Tonkolili deposit but, dependant as the firm was on this single asset, it was unable to cope with the huge drop in the global iron ore price.

Sierra Leone is a particularly sad case as it was looking forward to a sustainable recovery from years of civil war.

In 2011, the IMF predicted annual GDP growth at the unprecedented rate of more than 50%. On the strength of such forecasts, the country went on a credit binge to finance infrastructure, including a new international airport, and now finds itself in deep trouble.

The African Minerals model had assumed a price of about US$120 per ton. The company lacked a mining track record and had a chairman who had previously been warned off by the New York Stock Exchange.

Another project that appears to be in trouble is Sundance Resource’s Mbalam-Nabeba. Estimated at 35 million tons per annum, the deposit straddles the Cameroon/Congo border. Mbalam is in Cameroon and Nabeba in the Congo, both 500 km from the sea. The firm suspended its development study earlier this year.

Sundance has struggled to raise capital even in the best of times, having turned first to a Chinese and then a Ukrainian financier.

Clearly cash-strapped, the company’s board announced in December that it would be taking a 10% salary reduction.

The costs, for African governments, of dealing with small but ambitious players such as African Minerals and Sundance are now clear. Their limitations are all the more obvious when compared to the recent fortunes of the ‘big three’ in the industry.

BHP Billiton, Rio Tinto and Vale have the financial reserves, economies of scale and diversification to cut costs more than their tier-two competitors. They can engage in transfer pricing, thus ‘losing’ profits from one operation in losses elsewhere. In contrast, the small operators stand or fall by the outcome of a single project.

This year, Rio Tinto and Vale, especially, have continued to bring new production on-stream. But the market has fallen further and faster than anticipated.

In April, BHP Billiton was the first to blink: the company announced its intentions to slow down its expansion at Pilbara. It may be that the strategy of driving down prices to eliminate small competitors has run its course.

At the time of writing (in May), the price of iron ore had recovered to around US$60 per ton but unfortunately it will not be enough to save a number of smaller players that have become casualties.

Atlas Iron suspended trading on the Australian Stock Exchange earlier this year. Arrium in South Australia put up the shutters around the same time. Meanwhile, a number of state-owned Chinese producers have also ceased production.

Even Fortescue, Australia’s third-largest producer, has been vocal about how flooding the market constitutes unfair business practice. The company is heavily geared and analysts expect it to have to sell assets to survive.

Last year, premier iron ore market commentators Goldman Sachs predicted that a total production of 235 million tons will be taken out of the market. While the company said the market would be better for the removal of small high-cost producers, it also called the trend ‘the end of the iron age’.

Guinea, with one of the big players on board, has become part of the industry and can be expected to reap the benefits in time but it is less clear how other countries on the continent will be affected.