‘You are not safe in bonds, you are not safe in stocks, and you are not safe in cash. Which is why I choose gold. It doesn’t bring in income, but it will be around when everything else is in ruins.’ That was the view of US finance journalist Richard Russell, who started his investment advice column Dow Theory Letters in 1958.

Considering the performance of the gold price in 2024 (touching an all-time high of US$2 790 in October, with the price rising almost 30% over the year), it’s still a theory that holds sway. What’s bad news for global geopolitics, is generally good for gold.

‘Gold has been one of the best-performing commodities over the past year as the metal regained its status as a safe-haven asset in times of uncertainty,’ notes PwC’s SA Mine 2024 report. It also ascribes some of gold’s good fortunes to the collapse of the property market in China, which caused a fright flight of capital to traditional store-of-value assets.

Central banks have more than doubled their gold purchases over the past two years, according to John Reade, senior market strategist at the World Gold Council. Last year alone, central banks acquired 1 100 tons of gold – about 20% of the total gold production (including recycled jewellery).

The strong appetite for gold has set up some – not all – South African miners for a phenomenal year. While share price gains for gold miners averaged at 37% in South Africa, Harmony Gold’s share value soared 108%, the PwC report states. The miner is planning to spend ZAR10.8 billion in capex this year, ZAR500 million more than in 2024. About ZAR8 billion will go towards adding 13 years to the life of the world’s deepest mine, Mponeng, near Carletonville in Gauteng, where gold is extracted at 4 km beneath the surface.

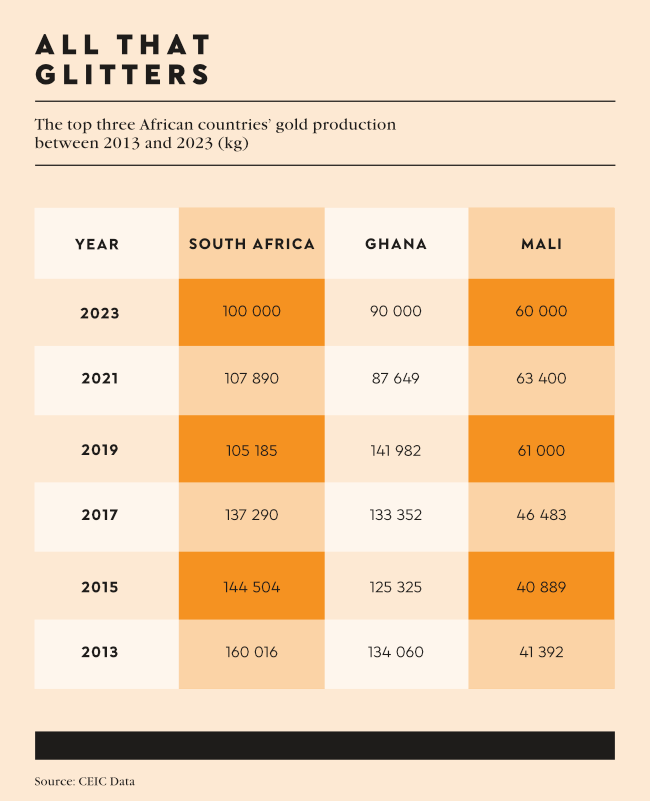

While in 2023 South Africa was the biggest gold producer regionally, it places ninth globally with 100 tons produced in 2023 – level with Uzbekistan, according to the latest Nasdaq figures. South Africa held the global number one spot for decades until 2006, but with gold production plummeting by 85% from 1980 to 2018, it ceded its position to China (370 tons in 2023). The country is still among the top three countries when it comes to gold reserves (5 000 tons out of an estimated global total of 54 000 tons). Unfortunately those reserves are kilometres underground – as seen at Mponeng – which means mining becomes incrementally more expensive and more dangerous. Thus, gold miners are looking at easier wins further north on the continent.

According to the Brookings Institute, gold mining production in Africa has risen by nearly 60% since 2010, and in at least 10 African countries it has more than doubled, outshining global production, which has grown by 26%. Relatively favourable tax regimes in the main and near surface-level mineralisation make West Africa in particular an attractive proposition.

In 2023 Ghana was the second-largest gold producer on the continent, with 90 tons of gold, 2 tons up from the previous year. This is considerably lower than its all-time high of 148 tons in 2018, when it was Africa’s largest producer. However it is still living up to its reputation as Africa’s Gold Coast, promising ‘commissioning galore’ in the near future.

Plans are already in motion to commission its first large-scale greenfields gold mine since 2013. Martin Ayisi, CEO of Ghana’s Minerals Commission, has nicknamed the China-owned Cardinal Namdini mine a ‘monster’, and it will produce an average of 358 000 oz a year.

Then, in the middle of 2025, US mining major Newmont will commission another ‘monster’, Ahafo North, which will contribute at least another 250 000 oz/y. Perth-based Azumah Resources’ Wa gold project in north-western Ghana is also expected to start production in 2026.

Other investments around the continent don’t quite meet ‘monster’ standards, but projected output is nonetheless respectable.

In October Canada’s Montage Gold announced it is investing US$825 million in the construction of its Koné project in Côte d’Ivoire, where pre-feasibility studies indicate that the mine has a 16-year mine life and is projected to produce 300 000 oz over the first eight years. Another Canadian miner pinning its hopes on Côte d’Ivoire is Roxgold, which invested US$127 million in opening the Seguela gold mine in 2023; it is projected to produce about 130 000 oz/y adding to the country’s annual output of around 50 tons.

While Mali is Africa’s third-biggest gold producer, mining around 60 tons in 2023, its production was expected to fall in 2024, albeit not as much as the 14% first predicted. Investors might be put off by the current security situation and a complicated legislative framework that permits more government involvement in the industry.

In the DRC, meanwhile, Kibali – Africa’s largest gold mine, producing more than 360 000oz of gold in 2023 – is consolidating new prospective fields for both gold and copper, allowing it to expand its footprint even further. Canadian owner Barrick calculates its total in-country investment at close to US$5 billion, including royalties, dividends, taxes and supplier payments. ‘Bearing in mind that Kibali is also a leader in automation, the mine is a real role model for mining in Africa,’ Barrick president and chief executive Mark Bristow told Engineering News earlier this year.

Kibali might soon have a challenger for the title of Africa’s biggest mine. Mike Fraser, CEO of Gold Fields, announced earlier this year that ‘significant progress’ is being made on its venture with AngloGold Ashanti in western Ghana. By merging their neighbouring Tarkwa and Iduapriem gold mines, the two companies aim to create what they say will be Africa’s biggest gold mine.

While Gold Fields and AngloGold Ashanti had hoped for parliamentary approval for the merger before the country’s elections at the end of 2024, that green light appears to still be pending. However, as Fraser told MiningMx earlier in 2024, ‘if not and it falls into next year [2025], we certainly don’t see this as a derailer for the JV whether the current ruling party continues, or the opposition gets into power. It just may delay it’.

While it still has a secondary listing on the JSE in South Africa, AngloGold Ashanti formally exited the country in 2023, moving its primary listing to the NYSE, and selling off assets, including Mponeng, to Harmony Gold.

AngloGold – through its November 2024 acquisition of Centamin for US$2.5 billion – has acquired a 50% stake in the al-Sukari gold mine in Egypt’s mineral-rich Eastern Desert. The mine is located within the Egyptian Nubian Shield, where gold mining has been traced back to the Pharaonic and Roman ages. The mine produced about 450 000 oz/y in 2023.

Much further south, Zimbabwe too is stepping up exploration for gold. The Caledonia Mining Company, for example, is investing US$34million in expanding operations at Blanket mine, further exploiting the Bilboes gold deposit, firming up production capacity to 170 000 oz/y.

Back in South Africa, Gold Fields is investing ZAR21 billion in infrastructure upgrades and fleet management in a bid to ramp up production at its 22-year-old South Deep mine near Westonaria, Gauteng. While its 2024 production guidance has been reduced to between 250 000 oz and 264 000 oz, this sets up the mine for improved performance in 2025. Gold Fields believes that with an 80-year life-of-mine, South Deep is likely to be the last gold mine in South Africa.

Proving that there is indeed ‘gold in them thar hills’, DRDGOLD – one of the first South African companies to reprocess tailings to obtain minerals – produced more than 5 000 kg of gold worth about ZAR6.24 million in 2024. Meanwhile Pan African Resources’ ZAR2.5 billion investment in the Mogale tailings retreatment operation on the West Rand, which came on line in time and below budget in October, is expected to yield 50 000 to 60 000 oz/y for 20 years or more.

‘It’s quite ironic. We’ve been pretty much all over Africa looking for opportunities in terms of expanding our business and, ultimately, we’ve come back to South Africa – and less than an hour from our corporate office, we have 1.1 million oz of recoverable gold reserve here, and we acquired all of it for just over US$1/oz, which is fantastic,’ Pan African CEO Cobus Loots told Mining Weekly.

He pointed out that with the output from its Elikhulu and Barberton operations, ‘we’re basically producing more than 100 000 oz of gold per annum from these really low-cost operations’. Its total gold production is projected to reach 220 000 oz this financial year, while its Soweto Cluster could add another 50 000 oz.

With the gold price at these highs, gold miners on South Africa have been able to keep their heads above water. Whether they will continue to do so when gold loses its lustre, remains to be seen.