Copper, commonly referred to as ‘the red metal’, is sometimes also called ‘Doctor Copper’ by economists, because its price is so closely correlated to the health of the economy. It has such a wide range of applications – electrical equipment, vehicles, industrial machinery, construction, telecoms and appliances – that when the global economy is booming, demand for copper (and thus the metal’s price) is almost always high. Many believe that paying attention to supply and demand in the international copper industry is the best possible way of predicting what lies immediately ahead on the economic front.

For the past two decades, copper prices have been driven by demand from China, which consumes around half of the world’s copper, on both supply and demand sides. But the global COVID-19 lockdowns have been like running into a brick wall. Chinese manufacturing plants and Chilean mines (including the two biggest in the world) were shuttered to deal with health risks. The copper price plunged from more than US$6 000 per ton to US$4 774 per ton in mid-March 2020. In the face of the uncertainty, dire predictions were the order of the day, with Bloomberg Economics predicting China’s 2020 economic growth to come in at a miserable 1.4%, a far cry from the 5.9% it had forecast pre-coronavirus.

Even the pre-coronavirus prediction for China’s growth looked flabby next to the soaring figures a decade ago. Between 2003 and 2011, China’s annual GDP growth rate was around 10% (reaching more than 14% in 2007). The copper price reflected this, surging to a high of US$10 124 in February 2011. It was just more than US$6 000 at the beginning of 2020 before the impact of the global shutdown kicked-in. Yet the copper price had been under pressure even before the pandemic. Not only had global demand turned bearish, but the red metal was also a victim of the US-China trade war. In 2019, China imposed a 25% tariff on copper scrap imported from the US.

At the same time, social and civil rights protests in Chile disrupted production from that country, the world’s biggest copper miner, and China’s largest copper smelter, Dongying Fangyuan, was embroiled in a financial scandal that threatened to bring production to a halt.

These were confusing indicators for copper watchers. However, China’s recovery from the depths of the pandemic in the first half of 2020 was little short of spectacular. By the end of 2020, observers were predicting a GDP growth rate for the year of almost 5%.

As China has recovered, so has copper. In early December 2020, copper was trading at more than US$7 700 per ton on the London Metals Exchange. According to data processor, Trading Economics, such levels have not been seen since March 2013.

Copper’s recovery, even as the pandemic continues to batter developed Western economies, illustrates two points. One is the increasing global dominance of China – not only in manufacturing but in driving growth more generally. The other is the rising demand for renewable energy and electric vehicles (EVs). Green energy, transport and potential health applications appear on track to use higher volumes of the red metal in the future.

China’s key role is shown by its dominance of the lithium-ion battery market. The country’s two biggest producers account for a third of global production; the six largest battery manufacturers are Asian (South Korea’s LG Chem is the only non-Chinese company on the list); and of the 142 lithium-ion mega-plants under construction at end-2020, 107 were in China, compared to nine in the US.

According to the International Copper Association, renewable-energy power generators use eight to 12 times more copper per megawatt generated than fossil fuel-burning power stations. Wind-energy producers use between 2.5 and 6 tons of copper per MW, while solar PV uses about 4 tons per MW.

Since 2013, China has been implementing a series of renewable-energy plans, turning it into the world leader in this field. Although it might have fallen slightly short of its ambitious goals of installing 105 000 MW of solar PV generation capacity and the same in wind by 2020, after slashing feed-in tariffs in 2018, it represents a significant chunk of present and future demand for copper. The International Energy Association expects this demand to grow. It suggests that renewable-energy generation capacity will grow by 46% between 2018 and 2023.

However, renewable generation’s demand for copper is dwarfed by the potential of the EV industry. Again, the lead player is China, which has historically subsidised the purchase of EVs and restricted sales of fossil fuel-powered vehicles. China is by far the largest EV market – three times the size of the US – with 1.18 million vehicles sold in 2018.

According to the International Copper Alliance, EVs require between 40 kg and 83 kg of copper compared to 23 kg for the average combustible engine. For China, that means an annual demand for 400 000 tons of copper for a market that is still in its infancy. EVs make up just 3.8% of the Chinese car market, but that proportion is expected to change dramatically in the next few years. Some suggest it could rise to 50% by 2025 in a market in which 1.2 million units were sold in 2019. The government’s official target for EVs is one-fifth of new car sales by 2025.

2020 was a critical year in China’s EV market development. Tesla began producing cars at its Shanghai mega-factory in January. Daimler, BMW and Volkswagen were scheduled to start production at new Chinese plants. These plans were only temporarily halted by the coronavirus. Going into 2021, Chinese EV manufacturing is strong and set to go global. While some start-ups have failed, companies established only in recent years are flying. NIO, backed by tech giant Alibaba, listed on the New York Stock Exchange in 2018. Its share price has appreciated 340% since then. Li Auto and Xpeng listed in the US in 2020 and had gained 65% and 35% respectively by the end of the year. Hong Kong-listed and Warren Buffet-backed BYD soared 250% last year.

It could be that Tesla, whose Model 3 was the bestselling EV in China in 2020, is simply offering a more attractive product than its local rivals, many of which are short-range EVs. About half of the government incentives for these manufacturers were withdrawn in 2018.

Yet the EV market in China will grow, if only because it is part of a state-capitalist system that mixes market incentives with government control. While the Chinese government wants rapid development of the EV market, it does not want this to be so fast that it threatens jobs in the traditional automotive sector. Copper miners will be pleased to know that the Chinese government has given no sign that it is backing off on EV development.

Another area of possible demand growth for copper is in the health sector. A 2015 study by the UK’s University of Southampton found that copper can effectively help prevent the spread of respiratory viruses, including coronaviruses such as SARS and MERS. The initial excitement was related to the ‘superbug’ issue, which has become a concern as bacteriological and viral antibiotic resistance has grown.

The prospects for copper in health facilities were boosted when several US research institutions, including the Centres for Disease Control, announced in March 2020 that copper surfaces prevented the spread of COVID-19. It could not be detected after four hours of exposure on copper surfaces yet remained on plastic and stainless steel for up to three days. Diversified major Teck Resources has launched pilot projects in health and public transport facilities in Canada and Chile. However, it is early days, and replacing plastic, steel and glass surfaces with copper on a wide scale may be prohibitively expensive.

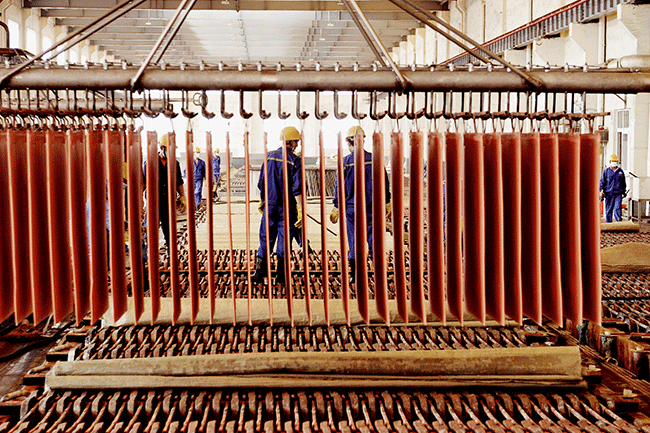

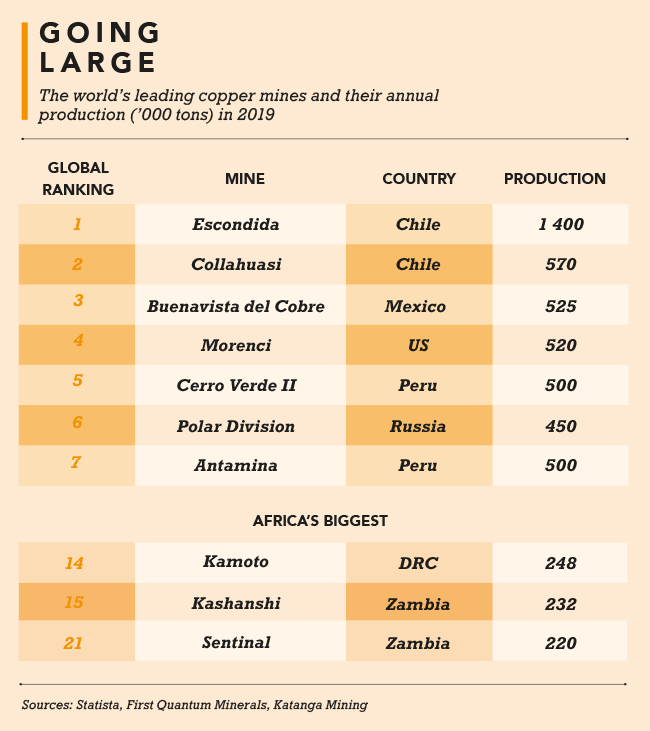

The demand side of Doctor Copper’s equation looks to be secure once the coronavirus shock is over. But what of the supply side? This is where the experts anticipate possible problems. Most of the world’s big copper mines are ageing and ore grades have fallen significantly. Grades in Chile have declined from more than 1.25% in 1999 to below 0.75% as of end-2019. This means that new high-grade mines – including Ivanhoe’s Kakula mine in the DRC – are sitting pretty.

Kakula, which will rival three other copper mines – in Indonesia, Mongolia and the US – for the title of second-biggest copper mine in the world, behind Chile’s Escondida mine, was reported in February 2020 to be ahead of schedule for initial production in the third-quarter of 2021. The mine will have an ore grade of 6.8% for the first five years of its life, and its backers may find they have invested in one of the best businesses in the world.