While the international minerals and energy sectors struggle in the face of challenges such as low commodity prices and sluggish demand – due largely to low GDP growth across the spectrum – Richards Bay Minerals (RBM) has sustained its position as one of the world’s largest suppliers of titanium feedstock (titania slag and rutile).

When adding to that the production of more than 30% of the world’s zircon and 25% of global high-purity iron, RBM has the capacity to produce up to 2 million tons of product per annum from its operation in KwaZulu-Natal (KZN), South Africa. Its current production is just 500 000 tons short of operating at full capacity – given slow demand – but that hasn’t stopped RBM from achieving other milestones over the past five years.

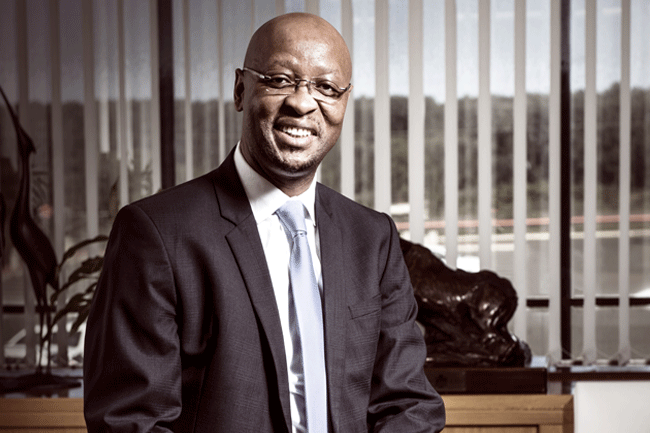

‘The most significant message is the confidence that Rio Tinto, our major shareholder, has in our operations,’ according to RBM CEO Mpho Mothoa. ‘In 2012 it doubled its shareholding, which was a shot of confidence in our capabilities. As the largest FDI transaction in South Africa that year, at US$1.8 billion, it constituted one-third of SA’s total FDI.’

Interestingly, RBM is the KZN province’s single-largest taxpayer and has remained so over the past five years. Mothoa says that while RBM may not be considered a big player in South Africa, its impact on the provincial government’s economic performance is, however, huge.

‘5% of the province’s GDP comes from RBM. This is largely because 95% of our product is exported and RBM contributes 50% of KZN’s mining sector by value of output,’ he says.

South Africa does not have a significant downstream industry for the minerals RBM produces, but that has not stopped the considerable organic growth experienced by the organisation during the course of the past four decades. Celebrating its 40th anniversary this year is yet another milestone for the company that originally produced just 400 000 tons of slag a year from one mining plant and two furnaces.

‘Our shareholders continued to receive dividends, which is testament to our endurance and sustainability during difficult economic conditions’

RBM’s success, according to Mothoa, is most attributable to the basic fundamentals that all mining operations should embrace, namely safety, partnerships, people, environmental care and growth.

‘At RBM we have made the people in our business a major focus because they are our greatest enablers.

‘In 2009 we introduced one of the biggest BEE transactions ever seen in this country by reaching out to the local host communities to acquire 10.8% of RBM. Black entrepreneurs were enabled with 13.2% and employees were granted 2%.’

The main thrust of the BEE deal was to ensure that RBM’s surrounding communities would benefit and use dividends to generate more projects, motivating social economic change that would in turn help locals to stand on their own and diversify any income that they received into new businesses.

‘The RBM BEE deal was proven to be one of the best empowerment models in the country because despite the global financial crisis in 2008/09, our shareholders continued to receive dividends, which is also testament to our endurance and sustainability during difficult economic conditions,’ says Mothoa.

The challenge, however, remains in how to stay ahead of the pack and maintain sector leadership. While not currently in a growth phase, Mothoa maintains that transformation remains a priority. Here he is not referring to human-capital empowerment alone but also a challenge that the entire industry faces – finding efficient ways to extract minerals.

‘From where I sit, the biggest opportunities for the mineral and energy sectors lie in productivity improvements across the board.

‘The solution can only be found once we all recognise that the costs of production are currently too high, and that product output per employee has dropped significantly. There are a number of reasons why this has happened – aside from global instability. Solutions include two major requirements: to upskill workers and improve on technology.’

A good balance of both is required because, as Mothoa says, it’s somewhat of a myth that mechanisation of mining operations will mean an increase in unemployment or retrenchments. ‘Instead, there are opportunities to generate downstream businesses – those that will support and service the new technologies. And again, this relates back to transforming, upskilling and uplifting those in our local communities.’

One real threat to remaining profitable in a South African mining environment, according to Mothoa, is the disenfranchised youth.

‘We all need to create an environment in which they can prosper, and this is why we use our presence to make a difference in their lives. If we don’t – and this affects every business – it will ultimately put our future business at risk.’

RBM has addressed this issue, and its internal drive for creating value, by promoting a safe and caring workplace that is fatality and injury free, and fully embracing the RBM mantra: responsible beyond mining.

‘Everything we do is approached with the view of creating a sustainable model. Take environmental concerns for example. Our approach is to prevent rather than correct. And when we can’t prevent, we have one of the most robust models to monitor impacts and immediately address those issues,’ says Mothoa.

It is a fact that RBM is recognised as a world leader in terms of dune rehabilitation, having made it a priority since inception. The landscape in which it operates is diverse, ranging from coastal dune forests and plantations to recreational and communal lands. As a result, RBM has enormous respect for biodiversity as well as ecosystems.

‘Our approach is to prevent rather than correct. And when we can’t prevent, we have one of the most robust models to monitor impacts and immediately address those issues’

A good example is Zulti South – it is set to expand operations before ultimately replacing the mining undertaken at Zulti North, which is nearing the end of its lifespan. RBM spent some ZAR500 million on an environmental feasibility study that it conducted at Zulti South.

RBM has won numerous environmental awards, for air quality; waste management; biodiversity; water conservation; and water demand management. Taking its Local Economic Development initiatives a step further is a ZAR100 million per annum investment in education beyond the life of mines; health; agriculture; business development; poverty alleviation; and infrastructure development.

‘We are concerned regarding the provision of basic services in the rural areas, which means we work tirelessly and partner with municipalities to bring much needed services into areas where such is desperately required,’ says Mothoa, who is himself somewhat of a philanthropist.

His philosophy is about courage and the ability to endure the knocks in life, and he is inspired by a quote by Winston Churchill: ‘Success is not final, failure is not fatal. It is the courage to continue that matters.’ It’s therefore not surprising that Mothoa is able to see the bigger picture of every aspect of his business and personal life.

‘It is crucial to engage people in ways they understand and remove any ambiguity. There is no point in painting a house on a hill without explaining what it means. Empowerment and upliftment can only be realised if context is understood. Thereafter you need to allow people to come up with the “how” of solving problems and trusting that they do the right thing.’

Mothoa’s legacy is inseparable from that of RBM and Rio Tinto. ‘I am here as the first black appointed CEO of the group in the country. This shows the pioneering nature of our shareholders, and I continue with their vision, which is to ensure we create a safe and caring workplace, and to ensure the organisation remains lean and value generating,’ he says.

‘By relentlessly focusing on value generation, I want to ensure that RBM creates a model operation of what mutually beneficial relationships can achieve.’