‘Mining remains so critical to South Africa through export and tax revenue that whatever happens in the mining sector significantly impacts the domestic economy. When mining underperforms, there’s a negative ripple effect. But it works both ways, as the mining windfall in 2021/22 illustrated by bringing huge benefits to the fiscus and the economy.’

Those were words from Busisiwe Mavuso, CEO of Business Leadership South Africa, quoted in the JSE quarterly magazine.

South Africa’s mining industry has been a cornerstone of the nation’s economic development for well more than a century. It is a sector that has shaped the country’s infrastructure, demographics and global standing. Mining is not merely an economic activity in South Africa; it is deeply intertwined with the socio-political and cultural fabric of the nation.

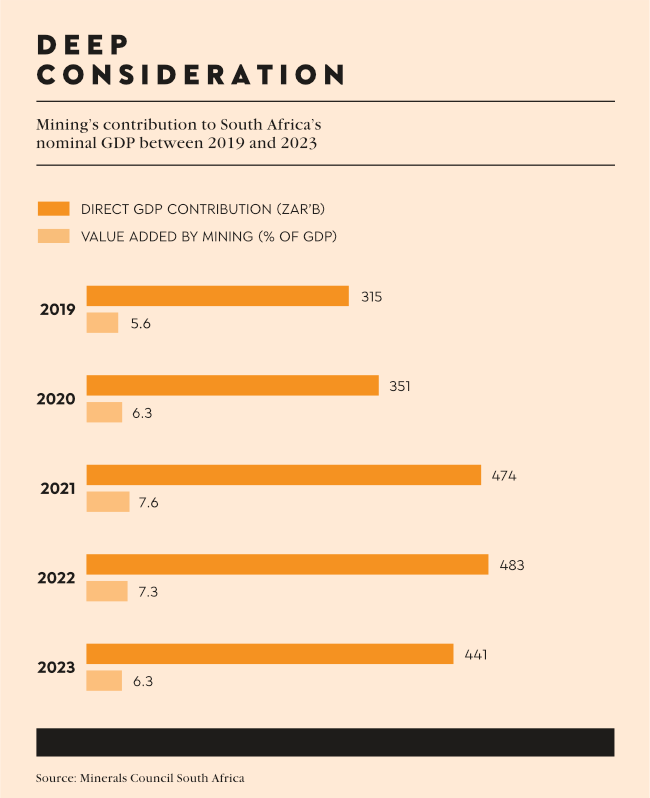

The facts speak for themselves… Mining contributed ZAR440.8 billion (6.3%) to South Africa’s GDP in 2023, with a total tax contribution of ZAR172.5 billion (an increase of 11%). The mining sector employs more than 480 000 people and mining companies have a huge social impact in their host communities through their investment in local infrastructure, education and health facilities.

The industry is also heavily involved in helping end the country’s energy crisis by investing in renewables – mining accounts for 70% of the confirmed utility-scale renewable energy projects (totalling 22 500 MW and ZAR390 billion in investment value), according to the publication.

Despite its importance, the mining sector in South Africa faces numerous challenges. Declining ore grades, increasing production costs and fluctuating commodity prices have placed pressure on profitability. Additionally, the industry is grappling with energy supply, crumbling rail and port infrastructure, and the need to transition to more sustainable practices in response to environmental concerns and climate change. Regulatory uncertainty has also been a significant issue.

Frequent changes to mining laws and inconsistent enforcement have created an unpredictable business environment, discouraging investment.

Given these challenges, it is imperative for the South African government and private sector to work together to provide targeted support to the mining industry. A stable and conducive policy environment is the foundation of a thriving mining sector. Clear, consistent and investor-friendly regulations will attract both domestic and international investment, ensuring the industry remains competitive on a global scale.

Investment in infrastructure is another critical area where government support and direction is needed. Reliable electricity, efficient transportation networks and modernised ports are essential for reducing production costs and improving the sector’s productivity. Rail and port inefficiencies cost South Africa’s coal and iron-ore bulk mining an estimated ZAR140 billion in lost revenue from 2021 to 2023, according to Kumba Iron Ore. Collaboration between government and the private sector in developing and maintaining such infrastructure will yield long-term benefits for the economy.

Speaking to Global Business Reports near the end of last year, Mzila Mthenjane, CEO of the Minerals Council South Africa, the body that represents the industry, laid out the organisation’s main targets.

‘Our top priority is ensuring that our members achieve their growth ambitions. Although recent improvements at Eskom and Transnet Freight Rail are positive developments, they may not immediately translate into expansion projects, as many of our members have already made capital investments but were forced to cut back operations due to constraints from these institutions. Re-employment of workers, following recent retrenchments, would be a strong signal of expansion and recovery.

‘However, creating new employment opportunities would be the clearest indication that we are moving towards the 3.3% growth target. Another crucial sign of progress is an increase in exploration spending. As the economy grows, so will the demand for capital, which will likely drive more junior mining companies to list on the Johannesburg Stock Exchange.

‘It’s important to recognise that economic growth is not an entitlement. It must be earned. We need to carefully consider the conditions we put in place to attract investment, balancing what benefits the government, the country and private sector investment.’

Mthenjane had some points on how the country could remain relevant as a leading global mining jurisdiction, too. ‘One of the key elements for remaining relevant in a low-carbon future is to leverage renewable energy sources, including green hydrogen, by tapping into the country’s abundant solar and wind resources. With an increasing and predominantly clean energy mix, combined with our strong position in the mining of iron ore, manganese and chrome, South Africa has the potential to participate meaningfully in green steel production, in alignment with emerging global regulatory frameworks related to carbon.

‘In addition, further exploration for battery metals is critical to gaining a better understanding of the country’s geological potential. To reclaim our relevance, exploration activities must increase significantly. Our goal should be to account for at least 5% of global exploration budgets once again.’

Investment and infrastructure was a theme that Mthenjane reiterated in his address earlier last year at the Joburg Indaba.

‘We’ve missed out on a couple of booms because of [inadequate] infrastructure, particularly logistics and electricity. Out of our total mineral production, about 50% relies on being transported by Transnet Freight Rail and 40% of mineral production relies on constant electricity supply. We are an industry that has spent a significant amount of capital, planning for increasing capacity, but was disappointed by infrastructure. As infrastructure performance improves, we’ll see the expansion of the industry.

‘The industry will need to reposition itself and [to ensure] that as network infrastructure performance improves, we can again see expansion in the industry. We’re in an industry where the world needs our products and South Africa is well-endowed with mineral resources. These two intersect at the right point in time,’ he said.

South Africa’s vast reserves of critical minerals such as rare earth elements, copper and manganese position the country as a pivotal player in the global transition to a more sustainable and climate-friendly future.

Critical minerals are indispensable for modern technologies. Rare earth elements are essential for the production of permanent magnets used in wind turbines and electric vehicle motors. Copper is a key component in electrical wiring, power generation and energy storage systems, while manganese is crucial for strengthening steel and as a component in battery technology. With demand for these materials surging globally, South Africa’s mineral wealth places it in a prime position to supply these resources to the world.

South Africa is already the largest global producer of manganese, accounting for approximately 40% of the world’s output. The country also holds significant reserves of copper and rare earth minerals, which underscores its strategic importance. Leveraging this potential effectively could see South Africa not only contributing to global sustainability efforts but also significantly bolstering its own economy.

‘Globally, the deal-critical minerals of focus were gold and copper – the prices of which performed exceptionally in the current year. For South African companies, it was no different. Copper and other strategic minerals have become increasingly sought-after as the world transitions to a low-carbon economy and the demand for clean energy solutions surges. Gold, on the other hand, continues to demonstrate its store of value in times of risk,’ was how Vuyiswa Khutlang, PwC South Africa mining assurance partner, described the situation in the PwC SA Mine Report 2024.

‘Unlike the previous downcycle, conservative capital allocation and rapid reaction on lower prices meant that balance sheets are still in relatively good shape despite a slight weakening in the past year,’ wrote Khutlang.

‘A strong balance sheet provides options in sourcing capital, which is critical for a cyclical industry. There are numerous capital sourcing options, but one of the trends we have noted is that mining companies are increasingly using green and sustainability loans to support operations which align with their own and global sustainability goals.’

Apart from the possibilities of critical minerals, the industry has been buoyed by news of the imminent implementation of a new cadastre system, expected to become operational in June 2025. Minister of Mineral and Petroleum Resources Gwede Mantashe, speaking at the Joburg Indaba, said that the first phase of the new licensing system was complete, ‘which included the assessment of the current environment to establish the baseline and its readiness and the requirements with respect to system hosting, software integration and the enhancement of cybersecurity’.

The industry also has hopes that the splitting by April this year of the Department of Mineral Resources and Energy, which oversees mining, into a Department of Minerals and a separate Department of Electricity and Energy, will reduce conflicts of interest and allow more of a focus on mining. ‘The review of mining regulations in South Africa by the Department of Mineral Resources and Energy presents a rare opportunity to create a well-considered and shared vision of a thriving mining industry that will benefit SA for generations to come,’ Mthenjane wrote in an op-ed article published in Business Day newspaper near the end of 2024.

‘The department’s review of the Mineral and Petroleum Resources Development Act is the opportunity to implement a pragmatic revision of the regulations and underlying policies that have stifled prospecting and new mine development because of uncertainty in the regulatory environment and concern about security of tenure.

‘There is a concern in the local mining industry that the department may use the opportunity when splitting out petroleum resources from the ambit of the act to revisit mining regulations and introduce damaging clauses that have negative unintended consequences and, possibly, to address setbacks it suffered in earlier court judgments.

‘It is more important than ever that ideological considerations and any intentions to settle old scores are set aside for the greater good of creating a conducive, flourishing and attractive mining sector for local and international investors. The focus should be to promote inclusive growth, job creation and increased tax generation, and foreign exchange earnings for the country.

‘A thriving mining industry that is growing has upstream and downstream benefits for other industrial sectors, including manufacturing and construction.

‘A growing mining sector will lead to greater demand for machines, equipment and products and boost the production of more metals and minerals that could supply local manufacturers to add value to our spectacular mineral wealth.’